33+ tax deductions mortgage interest

Taxpayers are eligible to deduct the interest paid on the first 750000 of their mortgage for primary homes second homes and home equity loans. But for loans taken out from.

Annual Report 2003 2004

Compare More Than Just Rates.

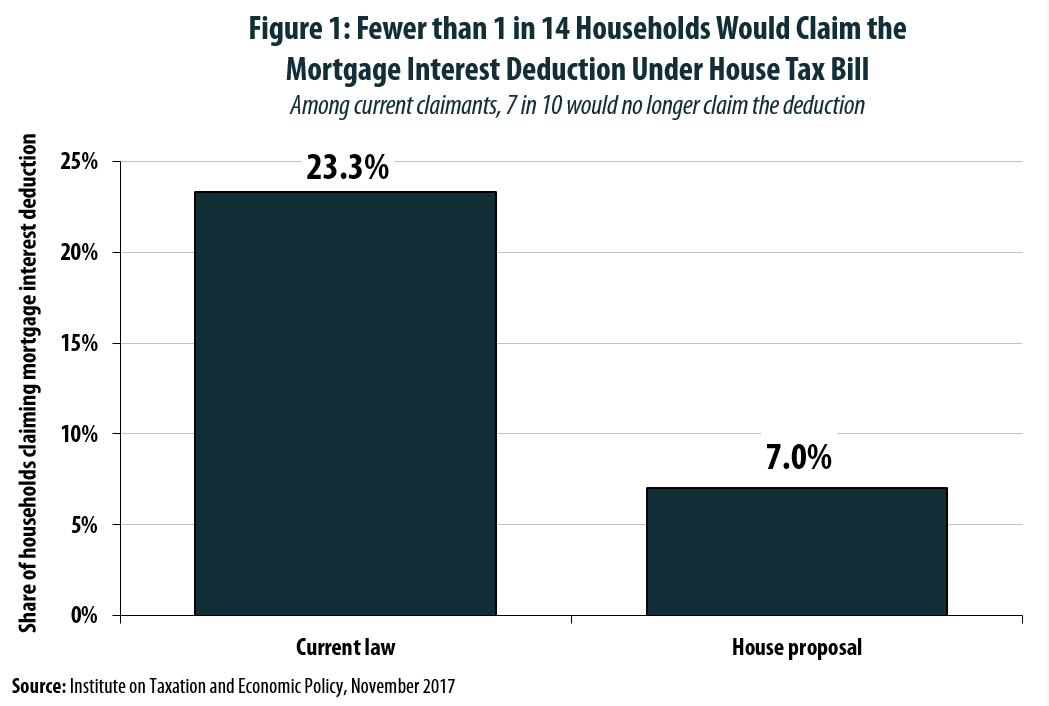

. Households claiming the home mortgage interest deduction declined. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Web Some TurboTax customers may be experiencing an issue because TurboTax isnt allowing qualified customers to deduct the full amount of their home mortgage interest. Web Answer a few questions to get started. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Web After Congress passed the Tax Cuts and Jobs Act of 2017 TCJA the number of US. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web The deduction for mortgage interest is available to taxpayers who choose to itemize.

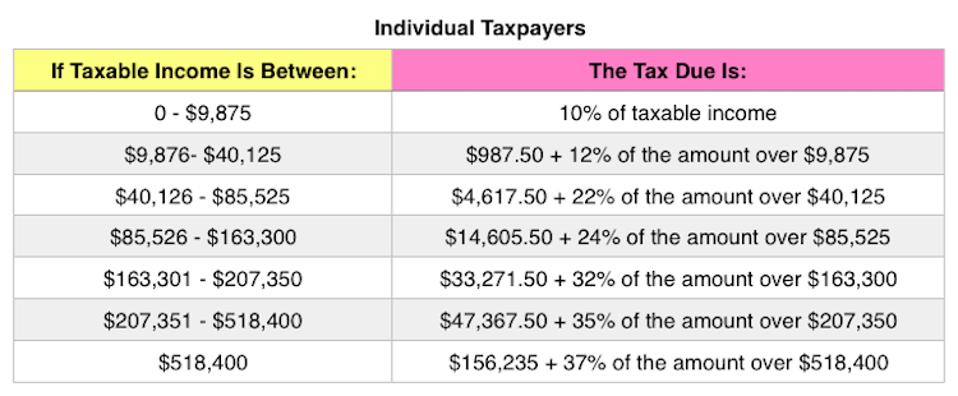

Additionally married taxpayers filing separately can each deduct up to 375000. Web March 4 2022 439 pm ET. Web A 1000 tax credit would reduce their total tax bill to 9000.

Taxes Can Be Complex. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Homeowners who are married but filing. If youd like to receive progress updates sign up below.

In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. Web Your mortgage interest will show on line 8b of your schedule A. However higher limitations 1.

Taxes can be complicated but it is worth considering the possible tax consequences of paying off your mortgage. 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply. Web Basic income information including amounts of your income.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web The mortgage interest deduction can also apply if you pay interest on a condo cooperative mobile home boat or RV used as a residence. Web The mortgage interest deduction is simply a tax deduction for the interest paid on your mortgage payment.

For married taxpayers filing separate returns the cap. Were working to resolve this issue. The 2017 Tax Cuts and Jobs Act changed.

30 x 12 360. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. There is also a known issue some users are experiencing with the Mortgage Interest.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web For 2021 tax returns the government has raised the standard deduction to.

Web Mortgage interest. Taxes Can Be Complex. Find A Lender That Offers Great Service.

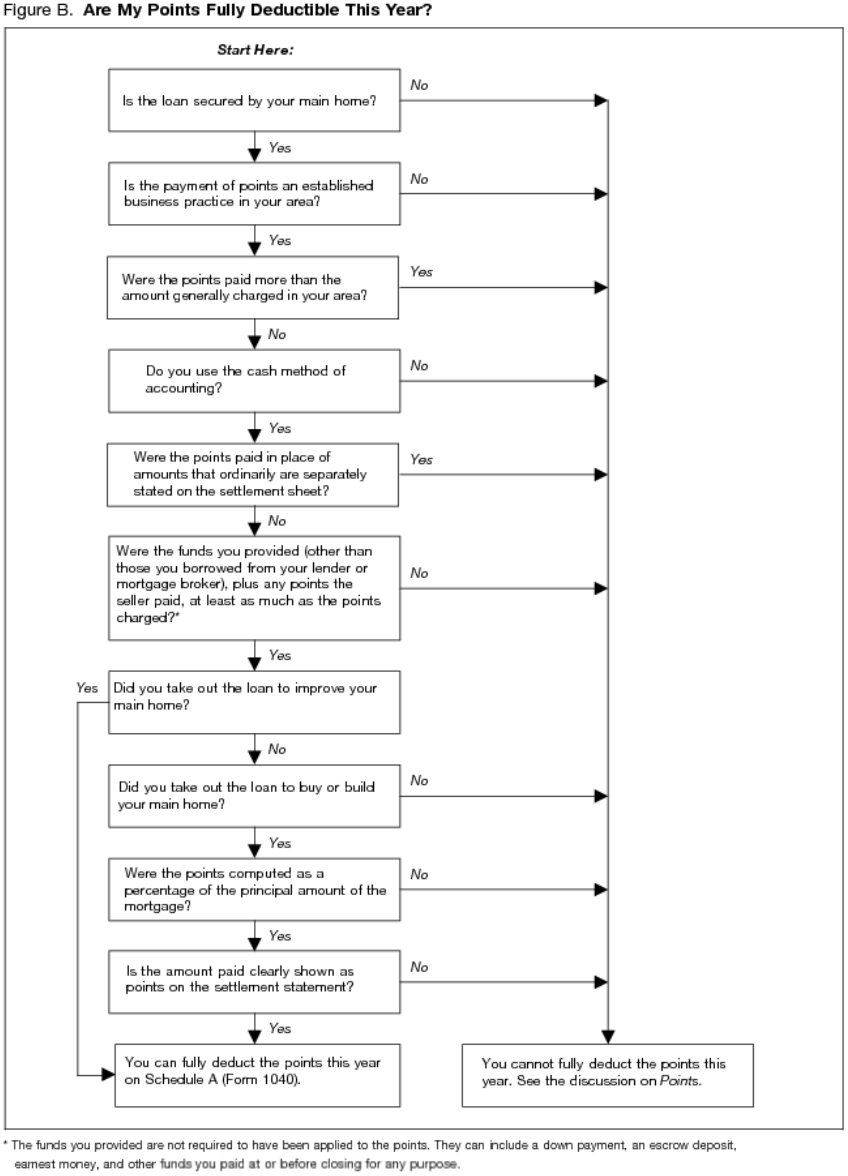

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Divide the cost of the points paid by the full term of the loan in. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

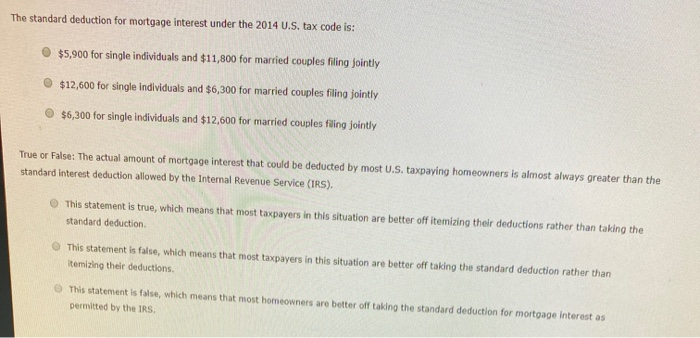

It allows taxpayers to deduct interest paid up to 750000 375000 for married filing. Web In order to itemize your return you would need to have itemized deductions greater than your standard deduction which is 25900 for a couple filing a joint return. A 1000 tax deduction would lower their taxable income from 67000 to 66000 -- at the expected.

Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator. Web Home mortgage interest. Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on.

Single or married filing separately 12550 Married filing jointly or qualifying widow er. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Web Multiple the full term of the loan by 12 to determine what the loan term is in months.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Take The Full Deduction On Mortgage Interest Ahead Of The New Tax Law Accountingweb

Mortgage Tax Deduction Calculator Homesite Mortgage

Solved The Standard Deduction For Mortgage Interest Under Chegg Com

What Tax Breaks Do Homeowners Get In New York

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Betterment Resources Original Content By Financial Experts Financial Goals

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction A Guide Rocket Mortgage

Real Estate Page 16 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

It S Time To Gut The Mortgage Interest Deduction

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Mortgage Interest Tax Deduction What You Need To Know

2020 Tax Deduction Amounts And More Heather