Bonus tax calculator 2021

The current Social Security tax rate is 62 percent for employees. Your employer must use the percentage.

What Is The Bonus Tax Rate For 2022 Hourly Inc

In many cases the IRS will use the percentage method because your employer will pay your bonus separate from your regular pay.

. Sage Income Tax Calculator. Bonus included in salary. If your state doesnt have a special supplemental rate see our aggregate bonus.

Easily manage tax compliance for the most complex states product types and scenarios. R258083 R260000. After subtracting these amounts if the total remuneration for the year including the bonus or increase is 5000 or less deduct 15 tax 10 in Quebec from the bonus or retroactive pay.

Add as a plugin or widget to any website. A tax calculator for the 2021 tax year including salary bonus travel allowance pension and annuity for different periods and age groups. Bonus Pay Calculator Tool.

If your total bonuses are higher than 1 million the first 1 million gets taxed at 22 and every dollar over that gets taxed at 37. Thandis total tax for March 2020 will then be. Free South African income tax calculator for 20212022.

Ad Accurately file and remit the sales tax you collect in all jurisdictions. The Ohio bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Youll notice this method gives a lower tax amount ie.

Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. YEAR 2022 2021 2020 GROSS SALARY NET BONUS Province Select one. In 2021 you will pay FICA taxes on the first 142800 you earn.

This is known as the Social Security wage. The Illinois bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Easily manage tax compliance for the most complex states product types and scenarios.

The aggregate method or the percentage method. Rate tables and calculator are available free from Avalara. Calculate how tax changes will affect your pocket.

Ad Download tables for tax rate by state or look up sales tax rates by individual address. The Viventium Bonus Calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses. With this tax method the IRS taxes your.

Learn how bonuses are taxed as taxable income in 2021 and 2022. Usual tax tax on bonus amount. All you need to do is enter your regular salary details and then enter the amount of the bonus.

Ad Accurately file and remit the sales tax you collect in all jurisdictions. Its so easy to. Ad Download tables for tax rate by state or look up sales tax rates by individual address.

Also understand how bonuses are taxed differently than regular wages and about withholding. The calculator assumes the bonus is a one-off amount within the tax year you. Calculates income tax monthly net salary bonus and lots more.

Calculate withholding on special wage payments such as bonuses. Employers typically use either of two methods for calculating federal tax withholding on your bonus. Avantis easy-to-use bonus calculator will determine the right pre-tax amount.

Alberta British Columbia Ontario. Rate tables and calculator are available free from Avalara.

3

1

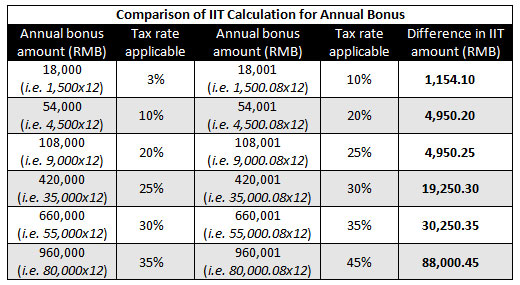

China Annual One Off Bonus What Is The Income Tax Policy Change

What Are Marriage Penalties And Bonuses Tax Policy Center

Avanti Bonus Calculator

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Calculating Individual Income Tax On Annual Bonus In China China Briefing News

Why Are Bonuses Taxed So High In Ontario Filing Taxes

Pin On Everything About Car Tyre

Everything You Need To Know About The Bonus Tax Method Rise

How Bonuses Are Taxed Calculator The Turbotax Blog

How Bonuses Are Taxed Calculator The Turbotax Blog

1

How To Calculate Bonuses For Employees

What Is The Bonus Tax Rate For 2022 Hourly Inc

1

Avanti Bonus Calculator